The US imposes a 46% reciprocal tax: How will Vietnam respond?

Vietnam is implementing many measures to respond to the 46% tax from the US, including reducing import taxes and increasing trade.

Listening to advice from businesses; reducing taxes on a number of groups of goods and industries imported from the US to Vietnam,

reviewing and removing technical barriers; responding to the issue of anti-origin fraud and illegal transshipment; increasing the import

of goods originating from the US... Vietnam has been actively implementing a series of measures to soon find a common voice in resolving

the issue of imposing import taxes on goods.

Timely and proactive intervention

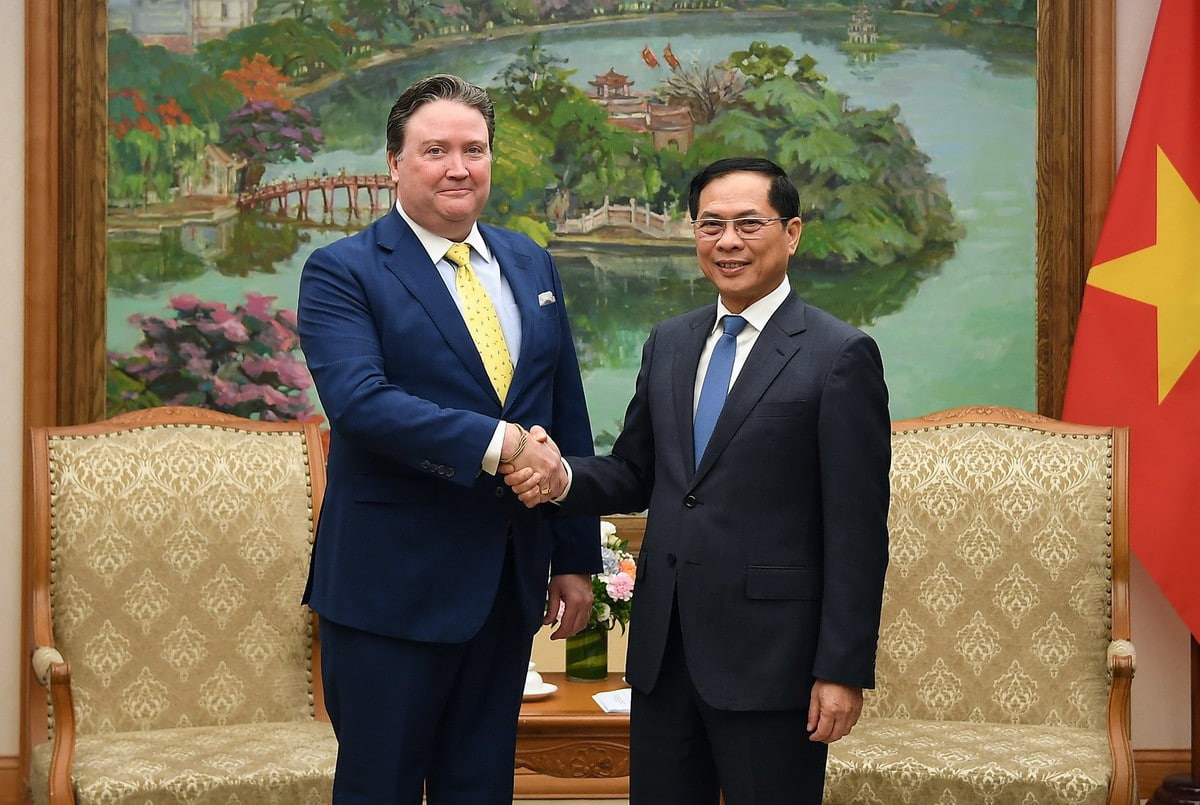

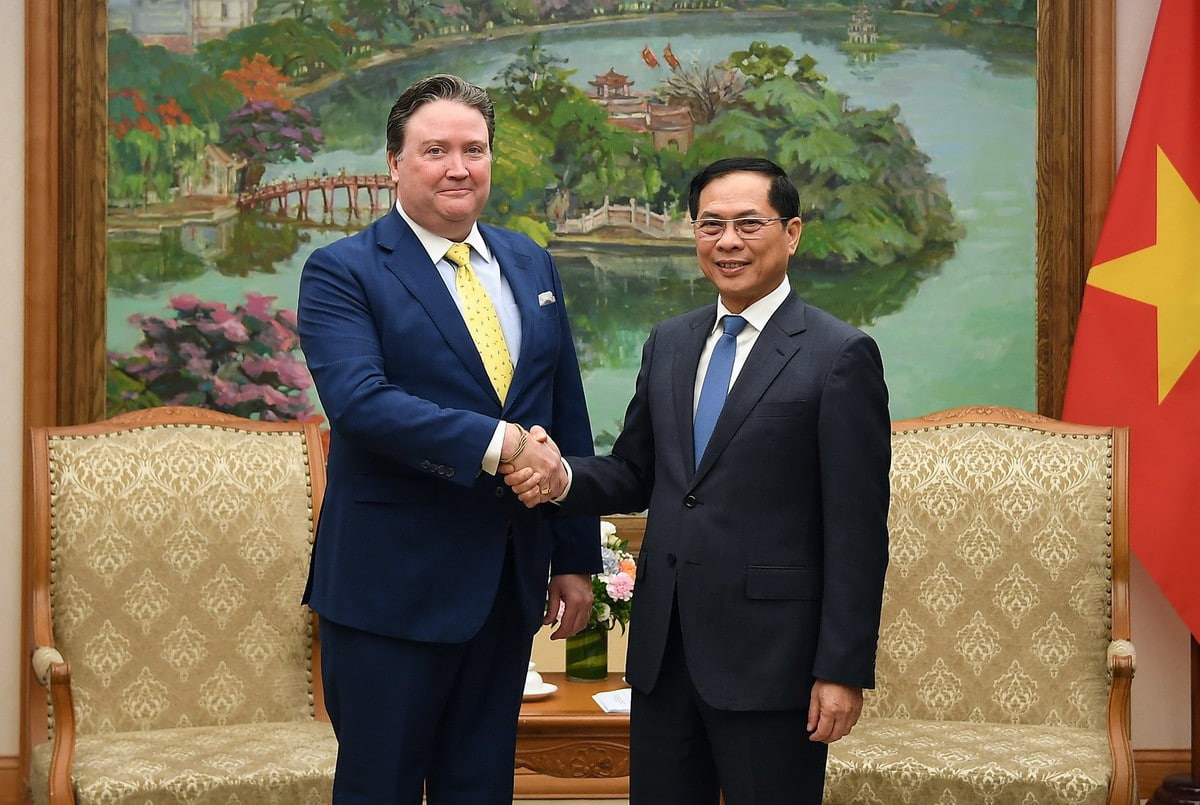

Consecutive days from April 3 to now, many meetings, working sessions, and phone calls have been held by the leaders of our Party and State to

discuss and resolve tariff barriers imposed by the US government, ensuring the harmony of interests for both sides.

Immediately after the US announced its reciprocal tax policy, on the morning of April 3, the Government Standing Committee convened an urgent

meeting to assess the situation and the impact of the US tax policy, and propose solutions to adapt to the situation.

At the same time, Minister of Industry and Trade Nguyen Hong Dien sent a diplomatic note to the US Trade Representative requesting to postpone

the decision to impose the above tax in order to discuss and find a harmonious solution; requesting to arrange a phone call as soon as possible to

discuss and handle this issue.

A Working Group on strengthening cooperation and proactively adapting to the US's economic and trade policy adjustments, headed by Deputy Prime

Minister Bui Thanh Son, was also established by the Prime Minister on the same day.

Working with businesses exporting goods to the US, associations and relevant agencies in the early afternoon of April 4, Deputy Prime Minister Ho Duc

Phoc listened to many valuable suggestions, removed difficulties and obstacles for exporting businesses, promoted the implementation of US projects

in Vietnam; adjusted some taxes on imported goods from the US...

On the evening of April 4, Vietnam time, General Secretary To Lam had a phone call with the Head of the White House.

During the phone call, the General Secretary affirmed that Vietnam is ready to discuss with the US side to reduce import tax to 0% for goods imported from the US,

and at the same time propose that the US apply the same tax rate to goods imported from Vietnam, continue to import more goods from the US that Vietnam

needs and encourage, create favorable conditions for companies from the US to increase investment in Vietnam.

The past two weekends continued with very urgent and continuous working sessions, showing the persistent efforts of the leaders.

ESOMAR Global Research Company will continue to update the latest news on the global market.

ESOMAR Vietnam Representative Office:

Address: 82 Nguyen Xi, Ward 26, Binh Thanh, Ho Chi Minh City

zalo:+84918082815

Contact Phone: 02855598501

Email: [email protected]

Official website (https://www.researchworld-vnm.com/)

Esomar VNM (https://esomarvnm.com/)